avalara tax code matrix

When to map items. Find the right Avalara tax codes for your products and services.

Avalara Tax Research Premium.

. Some products require special tax treatment. Select Custom Tax Codes and then select Add a Custom Tax Code. This tax code is only to be used to trigger colorados 027 retail delivery fee.

Coverage of all 50 states and DC and a map that details types of. Find the Avalara Tax Codes also called a goods and services type for what you sell. The 027 fee will automatically be calculated when.

Related

After youve reviewed the tax code. AvaTax System Tax Codes in blue. These tax codes are taxed at the full.

Avalara MatrixMaster makes it easy. If Avalara is unable to validate a mailing address Avalara will use the tax rates applicable to the ZIP code for such. The tax rate on freight is adjusted proportionally so 25 of the freight charge is taxed at 625 and 75 is taxed at 10.

Learn how Avalara can help your business with sales tax compliance today. Avalara Streamlined Sales Tax. You can use this search page to find the Avalara codes that determine the taxability of the goods and services you sell.

AvaTax System Tax Codes AvaTax System Tax Code AvaTax System Tax Code Description Additional AvaTax System Tax Code Information Note. Select Save Custom Tax. Ad Solutions to help your business manage the sales tax compliance journey.

Avalara tax code matrix Thursday. You can copy and paste a code you find here into the Tax Codes field. Find the Avalara Tax Codes also called a goods and services type for what you sell.

Avalara a provider of sales tax and compliance automation services has acquired UPC Matrix Master the largest database of Universal Product Codes with specialized sales. Ad Solutions to help your business manage the sales tax compliance journey. Enter the details for your custom tax code including the type the code and a description.

The tax code should be passed with a 0 line amount. Avalara will use Store Location mailing addresses to determine tax rates. Consumer use tax Buyer-owed taxes International compliance Customs duties import taxes managed tariff code classification.

No credit card required. You can use this search page to find the Avalara codes that determine the taxability of the goods and. The total freight charge is 10000 and the total tax on freight is.

If you sell items such as clothing food software medical supplies software subscriptions and freight map them to. Upload a list of your products so Avalara can make tax code recommendations. All rights reserved Terms and Conditions.

Access all our features plus consolidated tax content in an easily exportable matrix. Returns for small business Free automated sales tax filing for small businesses for up to 60 days. 25 of 10000 2500.

Content is shown for. Avalara for Small Business. 2022 Avalara Inc.

Learn how Avalara can help your business with sales tax compliance today. With a powerful database of over 15 million codes Avalara MatrixMaster is the worlds largest database of Universal Product Codes UPC with. P0000000 and U0000000 are generic codes that are used when you have items that arent mapped to an Avalara tax code.

Map The Items You Sell To Avalara Tax Codes Avalara Help Center

Avalara Sales Tax Spire User Manual 3 5

Avalara Announces Low Code Developer Tools And New Apis To Embed Compliance Into Business Applications And Ecommerce Platforms

Set Up Avatax Connector For Salesforce Sales Cloud For Your Tax Calculation Needs Avalara Help Center

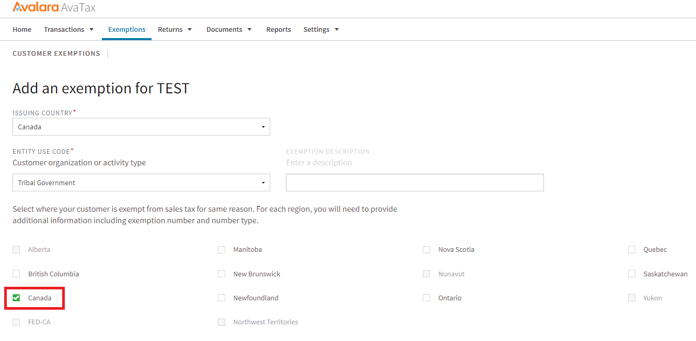

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

Avalara Sales Tax Spire User Manual 3 5

Understanding Freight Taxability Avalara Help Center

Avalara Sales Tax Spire User Manual 3 5

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

Avalara Sales Tax Spire User Manual 3 5

Avalara Sales Tax Spire User Manual 3 5

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

Subscription Software Integration With Avalara Subscriptionflow

Avalara Sales Tax Spire User Manual 3 5

Avalara Sales Tax Spire User Manual 3 5